Family Office product offering through FIF in IFSC Gift City

India’s most successful entrepreneurs, Mr. N R Narayana Murthy and Mr. Azim Premji are setting up a family investment fund in the IFSC in GIFT City, in the form of an LLP and their application is still at the regulatory stage.

There is continuous progress being made in the IFSC with large Indian and global investors coming forward to set up operations (for instance HDFCs insurance and AMC operations, Google’s large Fintech operation, and Deakin University of Australia setting up its campus)

On April 19, 2022, the International Financial Services Centre Authority (IFSCA) introduced the framework for Family Investment Funds (“FIFs”) under the IFSCA (Fund Management) Regulations, 2022 (“FM Regulations”).

Definition of Single-Family:

Single Family means a limited group of individuals all being lineal descendants of a common ancestor and their spouses and children. Also includes an entity either a sole proprietorship, Partnership Firm, LLP, Body corporate and Company, in which group of individuals in a single family hold up to 90% of economic interest.

Concept of FIF:

FIF is a powerful tool for building a diversified portfolio, reaching beyond domestic assets including a variety of international options, such as Listed and Unlisted securities and even tangible assets like real estate, bullion, and art with the benefit of favourable tax rates.

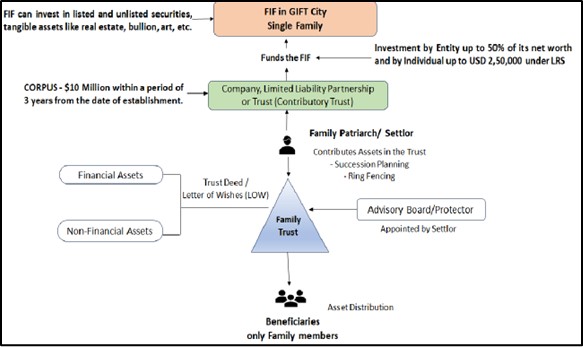

FIF in Gift IFSC aims to provide a formal structure to manage their investment funds, by setting up a dedicated entity to manage their investment activities, set up by a single-family office or entities under family control, to invest globally.

A FIF can be structured as a Company, Limited Liability Partnership or Trust (Contributory Trust).

Process of Setting up FIF in IFSC

- Identification of office space and obtaining a letter of approval.

- Approach for SEZ approval

- Enter into a lease agreement and a registered deed shall be submitted.

- Approach IFSC for approval for setting up FIF as an Authorized Fund Management Entity (FME)

Corpus

- The minimum corpus threshold of $10 Million within a period of 3 years from the date of establishment.

- May be open-ended or close-ended.

- No Net-worth requirement for FME registration

Investment Threshold

- Indian Entities: can contribute up to 50% of its net worth. The provisions as contained in Schedule II of FEM (Overseas Investment) Rules, 2022 provide that an Indian entity may make an Overseas Portfolio Investment which shall not exceed 50% of its net worth as on the date of its last audited balance sheet. “Net worth” of a registered partnership firm or Limited Liability Partnership (LLP) shall be the sum of the capital contribution of partners and undistributed profits of the partners after deducting therefrom the aggregate value of the accumulated losses, deferred expenditure and miscellaneous expenditure not written off, as per the last audited balance sheet.

- Individual investors: can invest up to USD 2,50,000 to FIF in each financial year, subject to the Liberalized Remittance Scheme (LRS). In the Union Budget 2023, the tax collection at source (TCS) for foreign remittances under LRS was raised from 5% to 20%.

Benefits of investing in FIF:

- The FIF is a tool for building a diversified portfolio, reaching beyond domestic assets to include a variety of international options, such as listed and unlisted securities, and even tangible assets like real estate, bullion, and art.

- Can make leveraged investments.

- Tax considerations and benefits at IFSC:

As per the IFSCA guidelines, the FIF can be structured as a Company, Limited Liability Partnership (LLP) or Trust (Contributory Trust).

| Particulars | Trust | LLP | Company |

| Taxation | Trustee liable to pay the

tax as representative of the beneficiaries |

Tax to be paid by LLP. | Tax to be paid by the

Company, as well as on its subsequent distribution to Shareholders. |

| Capital gain | Tax rate at 20% to 30% | Tax rate at 20% to 30% | Tax rate at 20% to 30% |

| Dividend and

Interest Income |

Maximum Tax rate at 30% | Tax rate at 30% | Tax rate at 22% to 30% |

| Tax liability to

the beneficiaries/partners/shareholders after distribution of profit by FIF |

Not taxable | Not taxable | Dividend distribution is

taxable at 30% in the hands of shareholders |

| Taxation on

Business Income |

Tax holiday for 10 years.

However, potential risk of other income being taxed at maximum marginal rate |

Tax holiday for 10 years | Tax holiday for 10 years |

Family Office Solution through FIF:

Structuring FIF as a corporate entity which is funded by a Single Family can ease the investment opportunities of the family.

The shares of this corporate entity which is set up by a family patriarch can be parked in a private family trust to ensure the succession planning and ring fencing of assets is addressed.

Please refer to the structure below for the structuring solution:

Capabilities of Catalyst Trusteeship Limited:

- Family office advisory, structuring, drafting and execution of Private Family Trust, legal entities (Company or LLP), FIF, etc.

- Advisory on structuring the FIF as per the family’s’ objectives in consonance with legal requirements.

- Assisting with Advisory services on regulatory and taxation requirements for compliant structures.

- Assistance in preparing legal documentation at various stages of Family trust, FIF, etc.

- End to end management and post setup requirements and compliance for FIF and private family trust.

Disclaimer: The information collected in this document has been collected from various sources. Catalyst has no responsibility for the accuracy, reliability and correctness of any information provided here. Catalyst does not warrant or represent that the information is free from errors or omission, or that it is exhaustive. Readers should conduct and rely upon their own examination and analysis for making their own assessment of the information and should verify all representations, statements, and information with their advisors. Also, the information contained herein is not be used as legal advice for specific legal problems.